unemployment tax forgiveness pa

Box 413 Milwaukee WI 53201-0413 Map. I did not get my Unemployment andor Workers Compensation account numbers what do I need to do.

Tax Stimulus Checks See The 14 States That Are Sending Out Tax Rebate Payments Marca

This research brief updates an original release in July 2022 to show data for two more recent months job openings jobs unemployment rates and labor force or one quarter employment by age group.

. Forgiveness of Paycheck Protection Program PPP Loans. Armed Forces is not taxable for Pennsylvania personal income tax purposes a taxpayer must include such compensation when determining eligibility for tax forgiveness on PA-40 Schedule SP. Human Resources Engelmann Hall Room 125 2033 E.

Active Search for Work. Form 940 Employers Annual Federal Unemployment FUTA Tax Return. Download Pennsylvania Form PA-40 ESR from the list of forms in the table below on this page.

In numbers far exceeding men. Select the IRS form and review your IL 1099-G Unemployment Form. Amended Returns Amends existing regulations to improve clarity.

Bond of Appointed Collectors. The simple 3rd STIMUlator Tax Tool can help you decide. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

List of Residents for Per Capita Tax Purposes. Pennsylvania offers assistance and other services to people and families in need. 9632 This section increases the amount of the tax exclusion for employer-provided dependent care assistance to 10500 in 2021.

9631 This section increases rate of the tax credit for child and dependent care expenses and makes the credit refundable. Women are registering to vote in Pa. Be informed and get ahead with.

The white house taking a big step toward addressing the nations growing student. CA-20 Don Beyer VA-08 Mike Kelly PA-16 Cathy McMorris Rodgers WA-05 and Don Bacon NE-02 reintroduced the Military Spouse Hiring. Third stimulus check details.

The Indiana unemployment denial appeal will be heard by an Administrative Law Judge. Check box 9 State Abbreviation code for IL. The estate or trust may be liable for FUTA tax and may have to file Form 940 if it paid wages of 1500 or more in any calendar quarter during the calendar year or the preceding calendar year or one or more employees.

Bidens tax plan is estimated to raise about 333 trillion over the next decade on a conventional basis and 278 trillion after accounting for the reduction in the size of the US. The PA State Grant Program is a financial assistance program that provides funding to eligible Pennsylvanians and helps them afford the costs of higher education at the undergraduate level. The WOTC program not only.

Biden rebukes the criticism that student-loan forgiveness is unfair asks if its fair for only multi-billion-dollar business owners to get tax breaks. The amount of need-based aid that a school offers is usually determined by the information a family provides on the Free Application for Federal Student Aid called the FAFSA and sometimes the. The IFO published a research brief that examines the factors that caused the PA labor force to contract by 110000 workers since the start of the pandemic.

If you have taxable income from self-employment interest dividends unemployment compensation and pensions you may have to pay estimated tax to the state of Pennsylvania. This notice will state whether or not he or she qualifies for benefits and explains how and why the decision was made. The state tax withholding can not be greater than the Unemployment Compensation.

PHEAA administers the PA State Grant Program at no cost to taxpayers ensuring that every dollar appropriated to the program goes directly to students. WOTC Work Opportunity Tax Credit is a federal tax credit available to employers rewarding them for every new hire who meets eligibility requirements. I want to do business in Pennsylvania where do I begin.

Appointment of Tax Collector in Certain Cases. And provide clear instructions for taxpayers regarding petitions for refunds. Make the correct and eFile your IL return again at no fees.

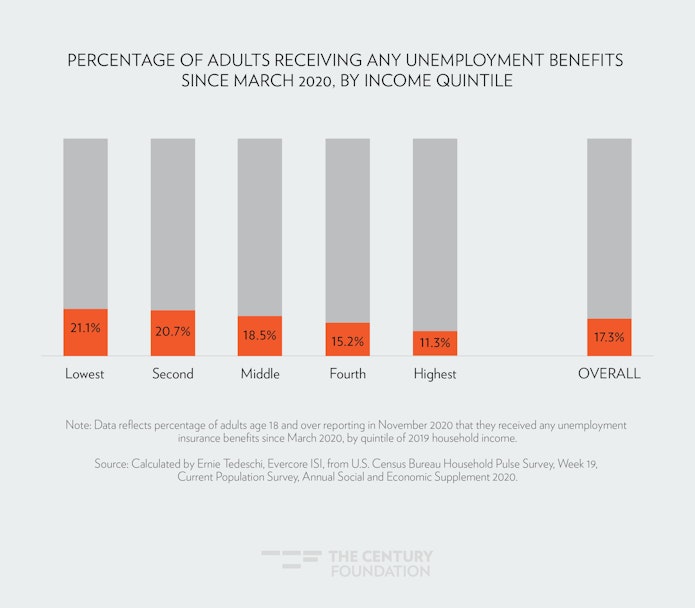

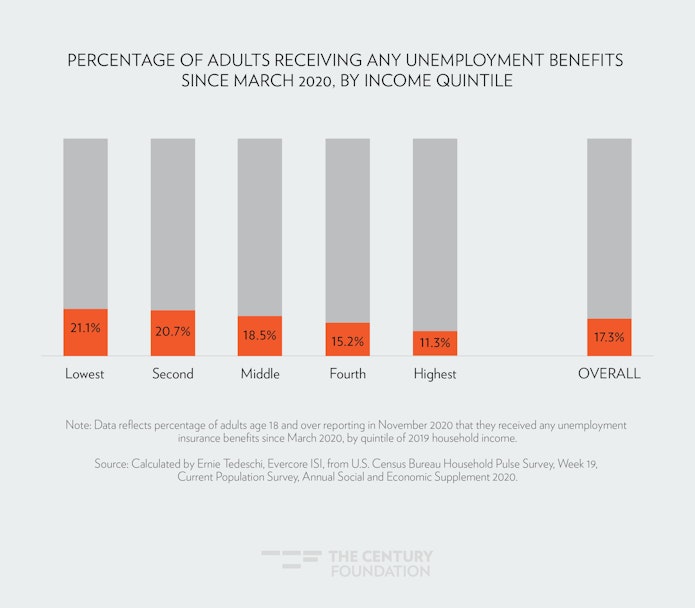

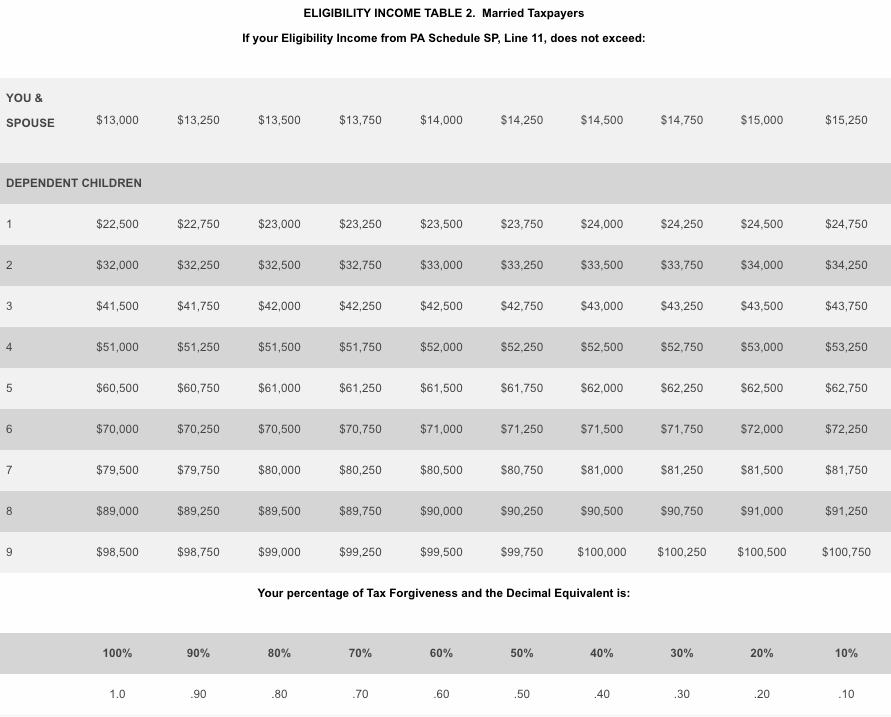

Tax Duplicates and Warrants. Low unemployment coupled w high wage-growth should be seen as a good thing even if it doesnt address all inequality. Eligibility Income for Tax Forgiveness Purposes While active duty pay and active duty for training pay received by a member of the US.

We will send you an email if your return got accepted or not. How can I add additional locations to my existing SalesEmployer tax registration. Pennsylvania Form PA-40 ESR is used to pay estimated taxes.

White House Communications Director Kate Bedingfield explains how the Biden administrations partial student loan forgiveness will benefit Americans amid inflation and an uncertain economic climate. But in order to receive the tax-free benefit her income had to stay at or below 90000. After an applicant has filed their unemployment claim he or she will receive a Determination of Eligibility through the mail.

2020 unemployment payment tax relief altered Child Tax Credit and increased 2021 Earned Income Tax Credit EITC updates are on the linked page. Temporary Continuance of Tax on Landfill or Resource Recovery Facilities. While taxpayers in the bottom four quintiles would see an increase in after-tax incomes in 2021 primarily due to the temporary CTC expansion by 2030 the plan would lead to lower.

Codify the Departments policy on amended returns for Pennsylvania personal income tax. In DC the current median household income as of 2020 was 90842 according to the US. It also increases the dollar limit on such expenses that are eligible for the credit.

How do I unlock andor reset my password to my e-Signature account e-TIDESPA-100.

California S Foreclosure Real Estate And Business Law Specialists Visit Estavillolaw Com For The Latest Forecl Avoid Foreclosure Foreclosures How To Find Out

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

The Case For Forgiving Taxes On Pandemic Unemployment Aid

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Cares Act Jjthecpahelp Com Acting The Borrowers Care

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

2400 Update Two Major Raises For Social Security Ssi Ssdi Stimulus Pa In 2022 Stock Market Tax Refund Daily News

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Deal Imminent Fourth Stimulus Check Update Unemployment Update The The Daily Show Daily News Child Tax Credit

What Are Marriage Penalties And Bonuses Tax Policy Center

Taxes Q A How Do I File If I Only Received Unemployment

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time