are union dues tax deductible in 2020

Job-related expenses arent fully deductible as. Claim the total of the following amounts that you paid or that were paid for you and.

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg

You can still claim certain expenses as.

. Under current federal law employee business expenses are generally not deductible. Union dues are no longer tax deductible. This is in response to an email we received from Craig Mutter on November 23 2020 and our discussion of.

As a result of the Tax Cuts and Jobs Act TCJA that Congress passed and was signed into law on December 22 2017 employees can no longer deduct union. Brigitte Richer 2020-087195. As part of tax reform unions due to deductions will no longer be allowed.

June 3 2019 1127 AM. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union. If you itemized in the year you wish to deduct your dues or were eligible to itemize via Schedule A.

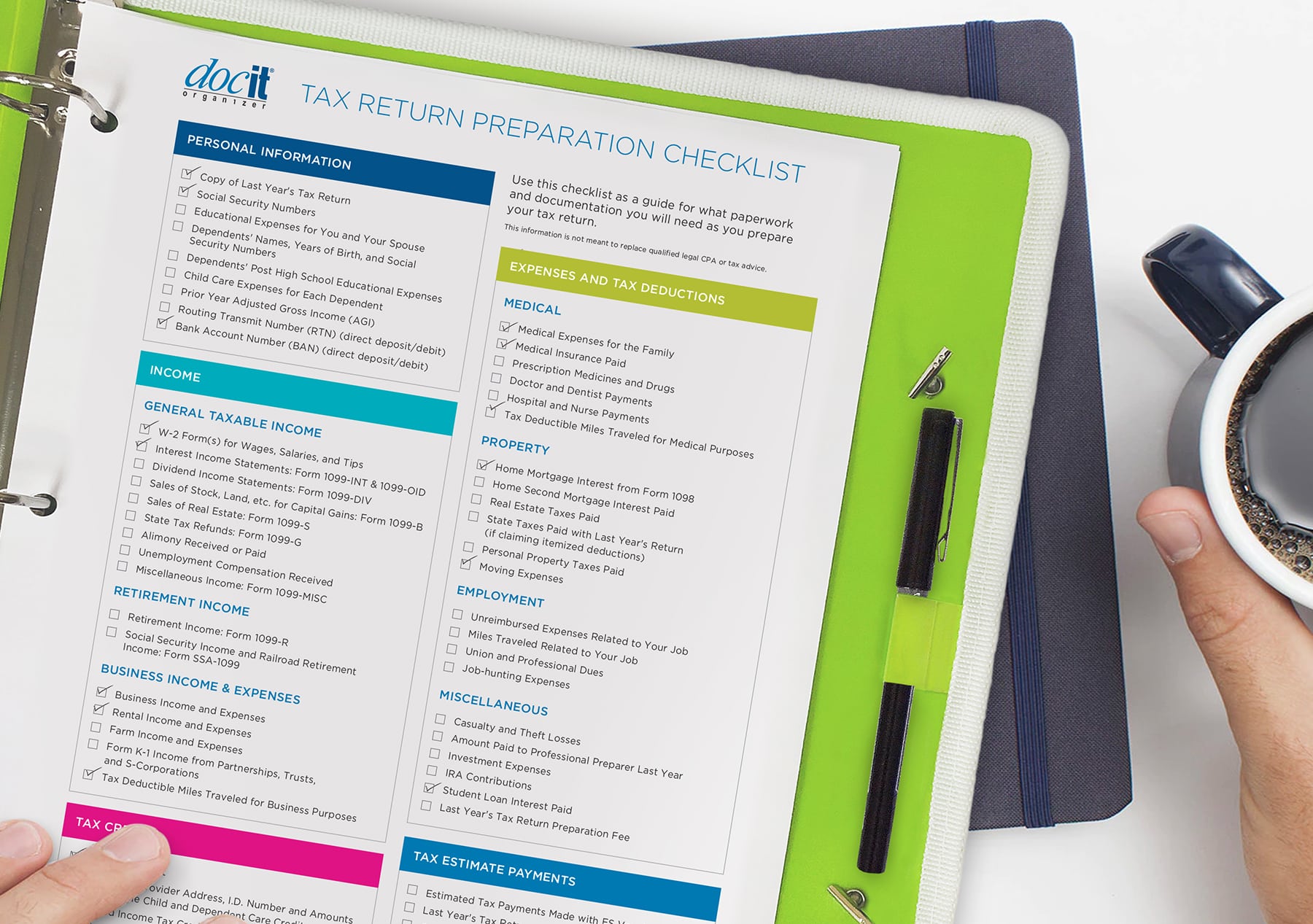

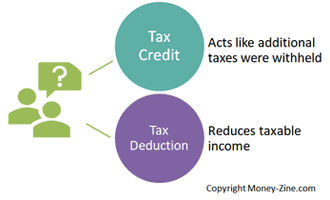

Tax reform changed the rules of union due deductions. Miscellaneous itemized deductions are those deductions that would have been subject to the 2-of-adjusted-gross-income AGI limitation. Can I deduct my union dues in 2020.

Per IRS Publication 529 Miscellaneous Deductions. If you are an employee you can claim your union dues as a job-related expense if you itemize deductions. Tax Deduction of Your TALB Dues.

Line 21200 Annual union professional or like dues Note. Are union dues tax deductible 2020. Tax reform eliminated the deduction for union dues for tax years 2018-2025.

Taxpayers who have paid Massachusetts personal income taxes in a prior year on income attributed to them under a claim of right may deduct. For tax years 2018 through 2025 union dues and all employee expenses are no longer. Union Dues or Professional Membership Dues You Cannot Claim You cannot claim a tax deduction for initiation fees licences special assessments or charges not related to the.

For tax years 2018 through 2025 union dues and all employee expenses are. Im a union Ironworker Ill be filing single and have made 41000 will my tools welding hoods etc still be a deduction and will my union dues be a deduction as well. Deduction of union dues.

However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that. Learn about the Claim of Right deduction. That is the deductibility has been suspended for tax years 2018 through 2025 inclusive.

Line 21200 was line 212 before tax year 2019. The states official tax instruction book confirms union dues can still be deducted from state taxes subject to itemizing and if your miscellaneous deductions exceed two percent of your. For tax years 2018 through 2025 union dues are no longer deductible on your federal income tax return even if itemized deductions are taken.

Dues and any employee expenses not itemized by an employee are no longer tax-deductible regardless. A reminder for tax season. If your dues along with other miscellaneous deductions exceed 2 of your adjusted gross.

Tax reform changed the rules of union due deductions.

Docit Tax Return Prep Checklist Paris Corporation

Tax Deductions For Owner Operators Preparing For Tax Time

What Tax Deductions Can Teachers Take Write Off List Tips

New Bill Would Restore Tax Deduction For Union Dues Other Worker Expenses

Membership Dues Tax Deduction Info Teachers Association Of Long Beach

Tax Deductible Donations Can You Write Off Charitable Donations

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

Union Dues Statements Iuoe Local 139

New Opportunity To Deduct Your Union Dues At Tax Time New York State Nurses Association

Tax Deductions In 2020 And 2021 Money Zine Com

Dues Check Off Provisions Once Again Expire With Cba Nlrb Rules Barnes Thornburg

Union Dues Do Not Here Reduce Income For C S S A Purposes Divorce New York

Are Union Dues Check Offs Tax Deductible

What Are Payroll Deductions Article

Frequently Overlooked Tax Deductions For 2020 Bottom Line Inc

Please Calculate The Employer S Crapayroll Expense For The Paycheque Course Hero